From the Wintrust Life Files: Cash value exit

From the Wintrust Life Files: Cash value exit

Life insurance premium financing is a valuable tool for clients who need life insurance but desire optionality. Here’s a look at one of our most successful cases that may provide insight into the true benefits of life insurance premium financing.

The situation

In early 2008, a client of one of our insurance advisors was evaluating the purchase of a $10 million whole life policy for estate planning purposes. As a third-generation commercial real estate investor, the client was quite comfortable with the idea of leverage and generally earmarked available cash on hand to augment potential investment opportunities.

The solution

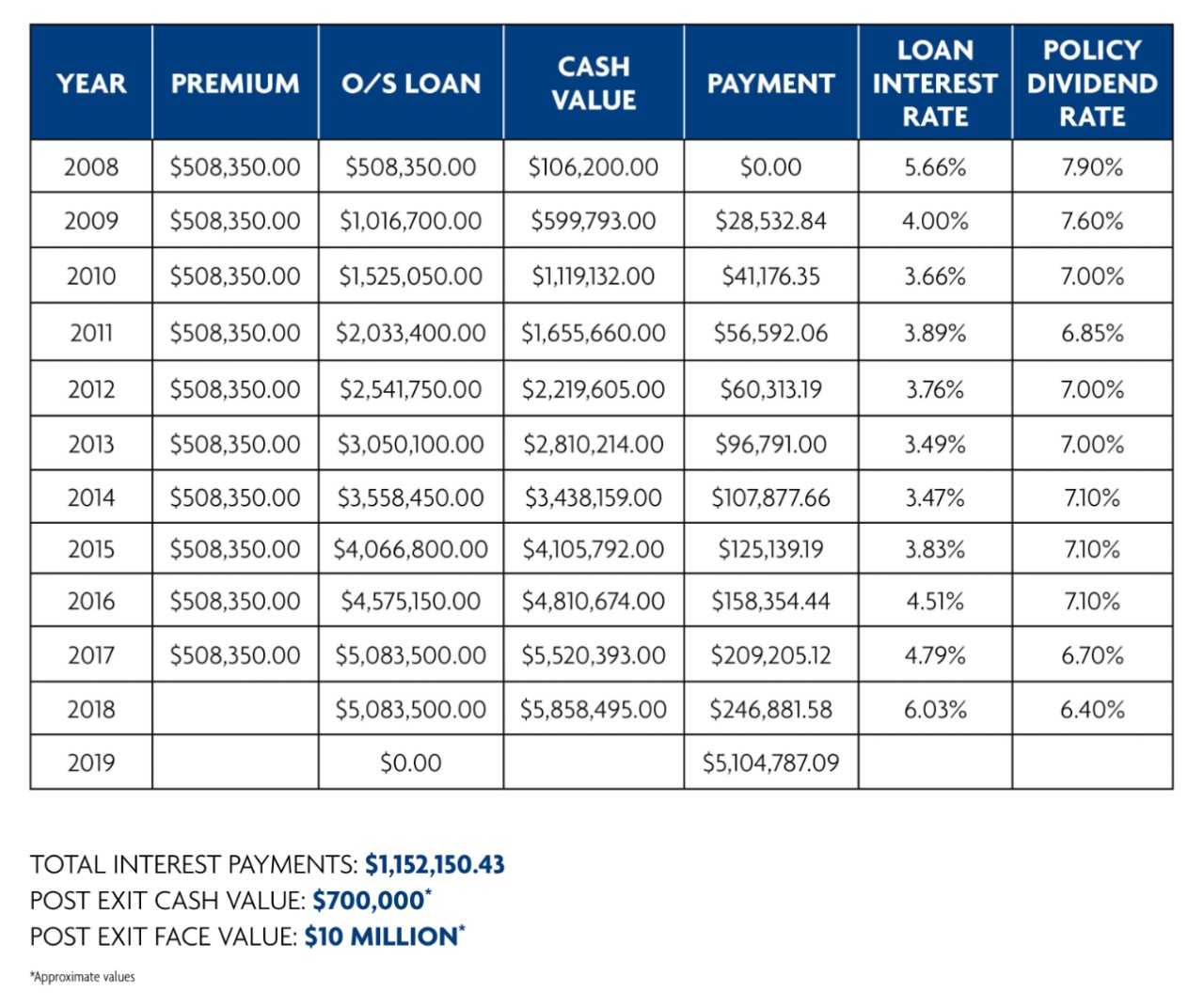

Understanding the client’s preference to optimize her liquidity position, the insurance advisor and Wintrust Life Finance structured a premium financing arrangement that called for annual funding of $500,000 for 10 years at an initial borrowing rate of 5.66%.

The client’s out of pocket obligation was pegged to simple interest payable annually in arrears. Projected accumulated cash value was identified as a potential future exit strategy, given the initial policy dividend rate of 7.9% exceeding the projected cost of capital. The client was pleased with the approach, and the transaction was originated in December of 2008.

In the 11th year of the financing arrangement, the client was able to exit the plan via cash equity of the insurance policy, leaving more than $700,000 of participating cash value and $10 million of paid-up death benefit.

The value of premium financing

By utilizing premium financing, the client realized significant cost savings versus other alternate funding scenarios for the permanent insurance coverage needed. The client was able to minimize her out of pocket outlay in early years and reinvest the retained capital in other opportunities, thereby substantially augmenting her true internal rate of return.